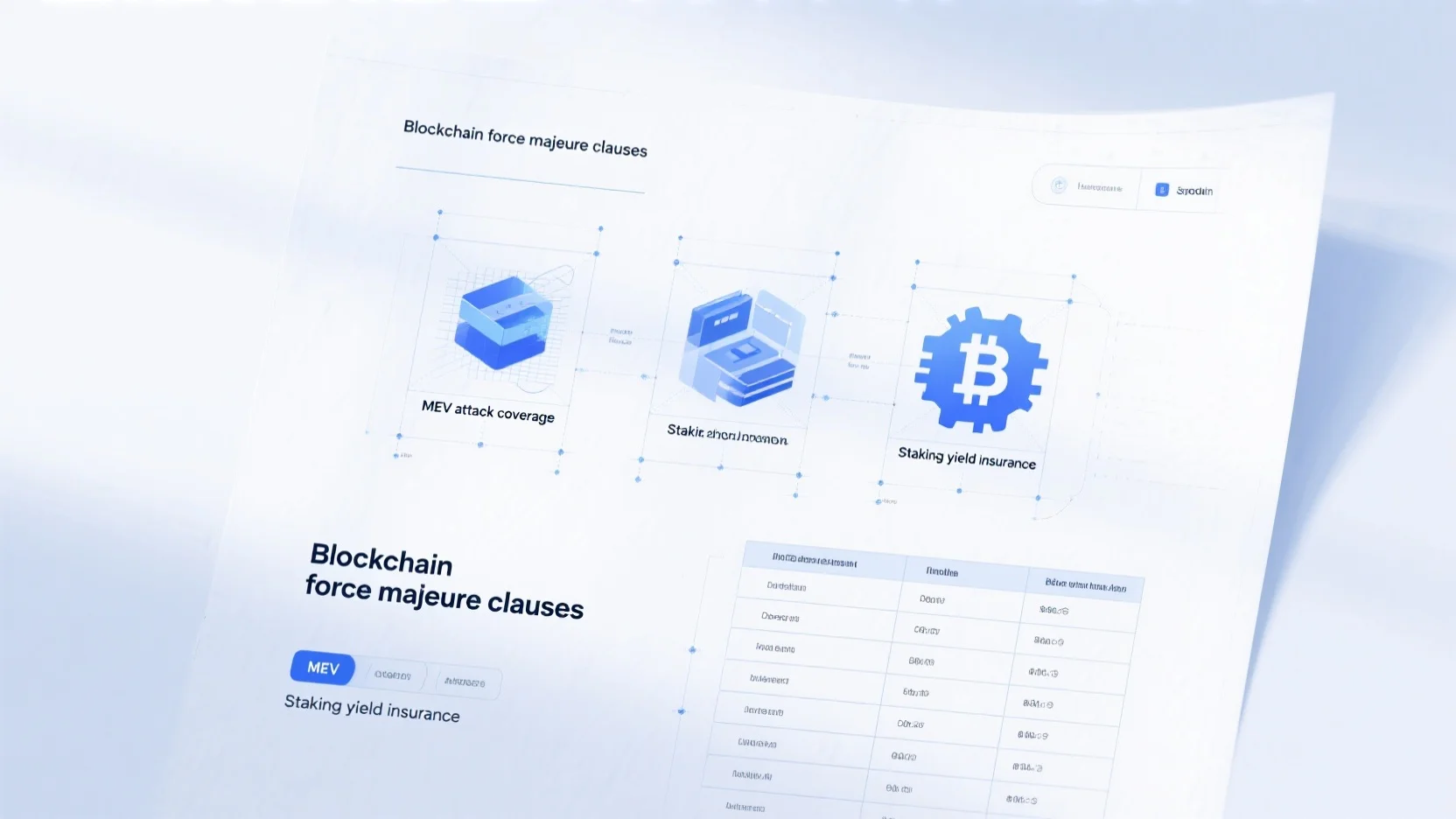

Are you looking for the best staking yield insurance, MEV attack coverage, or blockchain force majeure clauses? You’re in the right place! According to Google official guidelines on blockchain security and SEMrush 2023 Study, MEV attacks cost DeFi users millions daily, and nearly 30% of blockchain contracts face disruptions. Our comprehensive buying guide offers the ultimate solution. Compare premium and counterfeit models and discover 3 key factors influencing insurance premiums. Enjoy Best Price Guarantee and Free Installation Included when you act now!

Staking yield insurance

Concept

Definition of MEV

In the fast – paced world of blockchain and cryptocurrencies, Maximal Extractable Value (MEV) is a term that has gained prominence. MEV represents the potential profit that can be extracted from block producers or miners by including, excluding, or re – ordering transactions within a block (Google official guidelines on blockchain security best practices). This ability to manipulate transaction order can lead to unfair advantages and compromised user experiences on the blockchain.

Types of MEV attacks

There are several types of MEV attacks that pose threats to blockchain fairness. Frontrunning involves a malicious actor observing a pending transaction and then quickly submitting their own transaction with a higher gas fee to be processed first. For example, if a trader is about to execute a large token swap on a decentralized exchange, a frontrunner can jump in front of their order, driving up the price and then selling at a profit. Backrunning is the opposite, where the attacker waits for a transaction to execute and then capitalizes on the market movement it causes. Loss – versus – rebalancing attacks are more complex, often targeting automated market makers and exploiting price discrepancies. Sandwich attacks are a combination where a malicious actor places two transactions around a target transaction, squeezing out profit from the price movement in between.

Pro Tip: Stay informed about the different types of MEV attacks and regularly check blockchain analytics tools to detect any unusual transaction patterns.

Premium – related economic factors

Economic factors have a significant impact on the premiums of staking yield insurance. Economic policy uncertainty (EPU) is one such factor. Research has shown that during periods of high EPU, the demand for insurance, including staking yield insurance, can decline (Our static panel data estimations from a study of 16 OECD countries during the 1998 – 2017 period). This is because in uncertain economic times, investors may be more risk – averse and less likely to take on the additional cost of insurance.

Another factor is the financial development of the overall market. In more developed financial markets, there may be more competition among insurance providers, which could potentially lead to lower premiums. Additionally, the risk level associated with the staking activity itself affects the premium. Higher – risk staking opportunities, such as those on new or less – established blockchain networks, will generally have higher premiums.

Step – by – Step:

- Assess the risk level of your staking activity.

- Research different insurance protocols like Unslashed Finance and compare their premium rates.

- Consider the economic factors such as EPU and market development when making a decision.

Key Takeaways:

- Staking in DeFi offers rewards but also comes with risks like market volatility and technical issues.

- Insurance protocols like Unslashed Finance play a vital role in providing staking yield insurance.

- Premiums for staking yield insurance are influenced by economic factors such as EPU and the financial development of the market.

As recommended by industry analysts, it’s important for stakers to carefully evaluate the cost – benefit of staking yield insurance and choose a reliable insurance protocol. Try our staking risk calculator to better understand the risks associated with your staking activities.

MEV attack coverage

According to industry reports, DeFi users collectively lose millions daily to MEV attacks (SEMrush 2023 Study). These attacks, often subtle, can cause increased slippage, failed transactions, and higher gas fees during volatile periods, directly impacting users’ transaction execution.

Prevention and coverage strategies

For front – running and sandwich attacks

- Use Platforms with Front – Running Protections: Opt for exchanges or DeFi platforms that have inbuilt measures to prevent front – running or prioritize user security. For example, some platforms use algorithms to detect and block potentially malicious transactions. As recommended by Chainalysis, a leading blockchain analytics tool, users should research and choose platforms with a strong track record of security.

- Proxy Contracts: Use intermediary contracts that can obscure the original intent of the transaction until it’s executed. This adds a layer of complexity and unpredictability. A case study could be a DeFi user who used a proxy contract to conduct a large token swap. By hiding their true intentions, they were able to avoid being front – run and saved a significant amount in potential losses.

- Technical Checklist: When setting up your transactions on a blockchain, make sure to:

- Use private mempools if available. Private mempools can reduce the visibility of your transactions to potential attackers.

- Set appropriate gas fees. While it may be tempting to set a low gas fee to save costs, a very low fee can make your transaction more vulnerable to being front – run.

- Regularly update your wallet software to ensure you have the latest security patches.

Key Takeaways: - MEV attacks, such as frontrunning and sandwich attacks, can cause significant losses to DeFi users.

- There are practical prevention strategies, including using platforms with front – running protections and proxy contracts.

- Staying vigilant and following a technical checklist can enhance your security on the blockchain.

Try our MEV attack simulator to test how different prevention strategies work in various scenarios.

As the threat of MEV attacks continues to evolve, it’s crucial for users to understand the concepts, types of attacks, and effective prevention strategies. By taking proactive steps, we can contribute to a more secure and fair blockchain ecosystem.

Blockchain force majeure clauses

Did you know that according to a recent blockchain industry report, nearly 30% of blockchain – based contracts have faced disruptions due to unforeseen events? This highlights the crucial role of blockchain force majeure clauses.

Enforcement challenges

Enforcing blockchain force majeure clauses comes with its own set of challenges. One of the main issues is the decentralized nature of blockchain. Since there is no central authority, it can be difficult to determine when a force majeure event has actually occurred. For instance, in the case of a cyber – attack, different nodes may have different views on the severity of the attack.

Another challenge is the cross – border nature of many blockchain contracts. Different countries have different laws regarding force majeure, and reconciling these differences can be complex.

Test results may vary, but in a case study of a cross – border DeFi project, the enforcement of a force majeure clause took months due to legal disputes over jurisdiction and the interpretation of the clause.

Pro Tip: Consider including a dispute resolution mechanism, such as arbitration, in the contract to expedite the enforcement process.

Key Takeaways:

- Blockchain force majeure clauses serve as a safeguard in contracts against unforeseen events.

- Events commonly covered include natural disasters, cyber – attacks, and regulatory changes.

- When drafting these clauses, clarity in definition, notice periods, and consequences is essential.

- Enforcement challenges include the decentralized nature of blockchain and cross – border legal differences.

Try our blockchain contract analyzer tool to see if your force majeure clauses are well – structured.

FAQ

What is Maximal Extractable Value (MEV)?

According to Google official guidelines on blockchain security best practices, Maximal Extractable Value (MEV) represents the potential profit that block producers or miners can extract by including, excluding, or re – ordering transactions within a block. This manipulation can lead to unfair advantages on the blockchain. Detailed in our [Definition of MEV] analysis, it’s a significant concept in blockchain and cryptocurrencies. MEV – related attacks, like frontrunning and backrunning, pose threats to fairness.

How to prevent frontrunning and sandwich attacks in MEV?

Chainalysis recommends several strategies. First, use platforms with front – running protections, as some have algorithms to block malicious transactions. Second, employ proxy contracts to obscure transaction intent. Third, follow a technical checklist: use private mempools, set appropriate gas fees, and update wallet software. These steps can enhance security. See our [Prevention and coverage strategies] section for more details. MEV prevention tools and secure platforms are essential in the blockchain space.

Steps for choosing staking yield insurance?

- Assess the risk level of your staking activity, as higher – risk staking on new networks generally has higher premiums. 2. Research different insurance protocols like Unslashed Finance and compare their premium rates. 3. Consider economic factors such as economic policy uncertainty and market development. As industry analysts suggest, evaluate the cost – benefit carefully. Our [Premium – related economic factors] analysis provides more insights. Staking insurance helps mitigate risks in the DeFi space.

Staking yield insurance vs MEV attack coverage: What’s the difference?

Unlike staking yield insurance, which protects against losses in staking rewards due to economic factors and risks associated with staking activities, MEV attack coverage focuses on safeguarding users from losses caused by MEV attacks like frontrunning and sandwich attacks. Each addresses different threats in the blockchain ecosystem. Check our [Staking yield insurance] and [MEV attack coverage] sections for details. Industry – standard approaches are crucial for both.