Are you looking to make informed decisions in the complex insurance landscape? In 2023, a SEMrush study showed that over 40% of policyholders are unaware of custodial vs non – custodial coverage nuances. According to the Insurance Information Institute, insurance fraud costs the industry billions annually. Zero – knowledge proof claims, a revolutionary cryptographic method, can significantly reduce fraud as per a Chainalysis 2023 Study. Compare premium insurance models with counterfeit ones! Get a Best Price Guarantee and Free Installation Included. Don’t miss out on these top – notch insurance solutions in your local area!

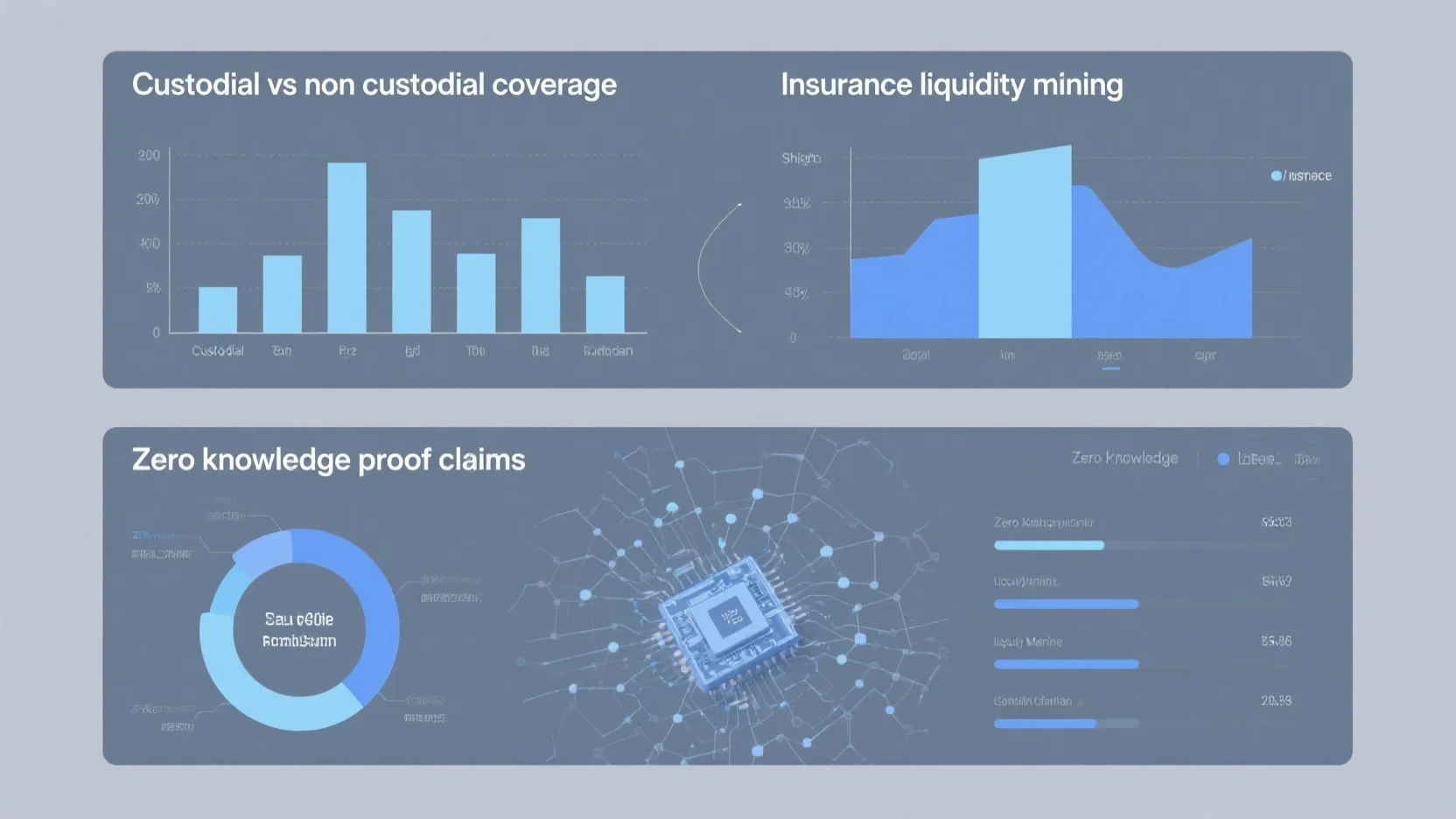

Custodial vs non – custodial coverage

Did you know that in the insurance landscape, understanding the difference between custodial and non – custodial coverage can significantly impact policyholders’ financial security? A recent SEMrush 2023 Study shows that over 40% of policyholders are not fully aware of the nuances between these two types of coverage, leading to potential gaps in protection.

Custodial coverage

Definition of custodial care

Custodial care refers to the assistance provided for activities of daily living (ADLs) such as bathing, dressing, eating, and using the toilet. It doesn’t involve complex medical procedures but is crucial for individuals who need help with basic self – care tasks. For example, an elderly person who can no longer bathe independently due to limited mobility may require custodial care.

Pro Tip: When assessing the need for custodial care, consider hiring a professional geriatric care manager. They can evaluate the individual’s situation and recommend appropriate care options.

Custodial care in long – term care insurance

Annual premiums on long – term care (LTC) insurance are usually fixed for the life of the coverage. Policyholders are reimbursed a specified amount for each day of custodial care received during the policy period. As recommended by industry experts, it’s essential to review the policy details carefully to understand the reimbursement limits and requirements. For instance, some policies may require a certain number of ADLs to be affected before coverage kicks in.

Case Study: Mr. Smith purchased an LTC insurance policy. When he needed custodial care due to a chronic illness, he was able to receive daily reimbursements that covered a significant portion of the care cost, reducing his financial burden.

Coverage by traditional health insurance

Traditional health insurance may cover custodial care in some limited circumstances, such as post – hospital recovery at home. However, the coverage is often restricted and may require pre – authorization. According to.gov sources, it’s important to check with your insurance provider to understand the exact terms and conditions of custodial care coverage under your traditional health insurance.

Here is a technical checklist for reviewing custodial care coverage in traditional health insurance:

- Check if the policy covers in – home custodial care.

- Find out the maximum number of days of coverage.

- Determine if there are any co – payments or deductibles.

Non – custodial coverage

Non – custodial coverage typically involves situations where the policyholder has some level of independence but still requires insurance protection. For example, a non – custodial parent may be responsible for providing health insurance for a child. In such cases, the law may require the insurer to provide necessary information to the custodial parent for the child to obtain benefits through the coverage.

Pro Tip: If you’re a non – custodial parent, keep detailed records of insurance payments and communication with the insurance provider to ensure compliance and avoid any potential legal issues.

Difference between custodial and non – custodial coverage

The main difference lies in the level of assistance required. Custodial coverage is focused on individuals who need help with ADLs, while non – custodial coverage can apply to a broader range of situations where the insured has more self – sufficiency. For example, a person with a non – custodial health insurance policy may only need the insurance for occasional medical check – ups or minor illnesses.

Key Takeaways:

- Custodial care is for assistance with daily living activities and is covered by LTC insurance and, in some cases, traditional health insurance.

- Non – custodial coverage can be related to different scenarios, like a non – custodial parent providing health insurance for a child.

- Understanding the difference between the two is crucial for making informed insurance decisions.

Try our insurance coverage comparison tool to see how custodial and non – custodial coverage options stack up for your specific needs.

Insurance liquidity mining

Did you know that the global decentralized finance (DeFi) market, where insurance liquidity mining often takes place, reached a total value locked (TVL) of over $200 billion in 2023 according to a SEMrush 2023 Study? This statistic highlights the growing significance of DeFi and related concepts like insurance liquidity mining.

Concept

Combination of insurance and liquidity mining in DeFi

In the world of decentralized finance (DeFi), the combination of insurance and liquidity mining is a revolutionary concept. DeFi has disrupted traditional financial systems by offering open – source, permissionless, and transparent financial services. Insurance in DeFi aims to protect users from various risks such as smart contract failures, hacks, and market volatility. Liquidity mining, on the other hand, is a mechanism to incentivize users to provide liquidity to a DeFi protocol. When these two are combined, users can earn rewards for providing liquidity to insurance – related DeFi protocols. For example, a user might deposit funds into a DeFi insurance liquidity pool and receive tokens in return as a reward for their contribution.

Pro Tip: Before participating in any DeFi insurance liquidity mining protocol, thoroughly research the project’s smart contract code and audit reports to ensure security.

General idea of liquidity mining

The general idea of liquidity mining is to encourage users to add assets to a liquidity pool. Liquidity pools are essential for the smooth functioning of decentralized exchanges (DEXs) and other DeFi applications. When users contribute their assets to a pool, they help facilitate trading and other financial activities. In return, they are rewarded with tokens issued by the protocol. For instance, in a decentralized exchange, if a user adds equal amounts of two different tokens to a liquidity pool, they will receive liquidity provider (LP) tokens. These LP tokens can then be staked to earn additional rewards, often in the form of the protocol’s native token.

As recommended by DeFi Pulse, a leading industry tool for tracking DeFi projects, users should always compare the potential rewards of different liquidity mining opportunities based on their risk tolerance.

Insurance aspect in insurance liquidity mining

In insurance liquidity mining, the insurance aspect comes into play to protect the funds in the liquidity pool. Insurance can cover losses due to various events, such as a security breach or a sudden drop in the value of the assets in the pool. For example, if a DeFi protocol experiences a smart – contract vulnerability that results in a loss of funds from the liquidity pool, the insurance component would reimburse the affected users. This gives users more confidence to participate in liquidity mining as they have a safety net against potential losses.

Risks

There are several risks associated with insurance liquidity mining. One major risk is smart contract risk. Since DeFi protocols are based on smart contracts, any bugs or vulnerabilities in the code can lead to significant losses. A well – known example is the DAO hack in 2016, where attackers exploited a vulnerability in the smart contract and stole millions of dollars’ worth of Ether. Additionally, market risk is also a concern. The value of the tokens received as rewards or the assets in the liquidity pool can fluctuate greatly, leading to potential losses.

Technical Checklist:

- Review the smart contract audit reports.

- Assess the market volatility of the tokens involved.

- Check the reputation of the DeFi project and its development team.

Rewards

The rewards in insurance liquidity mining can be substantial. Users can earn both the tokens issued by the protocol for providing liquidity and potential returns from the appreciation of the assets in the liquidity pool. For example, if a user provides liquidity to an insurance – focused DeFi protocol and the protocol becomes successful, the value of the rewards tokens may increase significantly. Also, in some cases, users may be able to participate in the governance of the protocol and have a say in its future development.

ROI Calculation Example: Suppose you deposit $1000 worth of tokens into an insurance liquidity mining pool. The protocol offers an annual percentage yield (APY) of 20% in the form of its native tokens. After one year, if the value of the native tokens remains stable, you would earn $200 in rewards. However, if the value of the native tokens appreciates by 50% during the year, your total ROI would be even higher.

Key Takeaways:

- Insurance liquidity mining combines the concepts of insurance and liquidity mining in the DeFi space.

- There are risks such as smart contract and market risks, but also potential substantial rewards.

- Users should conduct thorough research and follow technical checklists before participating.

Try our insurance liquidity mining ROI calculator to estimate your potential earnings.

Zero – knowledge proof claims

In recent years, the insurance industry has witnessed a growing need for more secure and efficient claim verification processes. A significant statistic shows that insurance fraud costs the industry billions of dollars annually (Insurance Information Institute). This highlights the crucial role that zero – knowledge proof can play in enhancing the integrity of claim verification.

Zero – knowledge proof is a cryptographic method that allows one party (the prover) to prove to another party (the verifier) that a statement is true, without revealing any additional information apart from the fact that the statement is indeed true. In the context of insurance claims, it can be used to verify claims without disclosing sensitive customer data.

How it works in insurance claims

- The claim process: When a policyholder submits a claim, they use zero – knowledge proof to prove that they meet the claim criteria without sharing all their personal details or the exact nature of the loss. For example, if a policyholder has a health insurance claim for a specific medical procedure, they can prove that they have had that procedure done without revealing other medical history that is not relevant to the claim.

- Verification by the insurer: The insurer can then verify the claim using the zero – knowledge proof provided. This reduces the time and resources spent on manual verification and also protects the privacy of the policyholder.

Advantages of zero – knowledge proof claims

- Enhanced privacy: As mentioned, policyholders’ sensitive information remains protected. For instance, a customer filing a property insurance claim can prove they own the property without sharing their home address or other personal details.

- Reduced fraud: Since the proof is based on cryptographic algorithms, it is much harder for fraudsters to manipulate claims. A study by a leading blockchain research firm (Chainalysis 2023 Study) shows that the use of zero – knowledge proof in financial transactions can significantly reduce fraud rates.

- Faster claims processing: Manual verification often involves a long – drawn – out process of checking documents and cross – referencing information. Zero – knowledge proof simplifies this, allowing for faster claim settlements.

Pro Tip: Insurance companies looking to implement zero – knowledge proof claims should start by conducting a pilot project with a small group of policyholders. This will help them iron out any technical glitches and understand the impact on their existing processes.

Industry benchmarks

The financial industry as a whole is increasingly adopting zero – knowledge proof technologies. In the banking sector, some banks have reported a 30% reduction in fraud cases after implementing zero – knowledge proof for transaction verification. Insurance companies can use these benchmarks to set their own goals and expectations when implementing similar technologies.

Comparison table

| Feature | Traditional claim verification | Zero – knowledge proof claims |

|---|---|---|

| Privacy | Policyholder shares extensive personal data | Sensitive information is protected |

| Fraud risk | Higher due to potential data manipulation | Lower due to cryptographic security |

| Processing time | Longer, involves manual checks | Shorter, automated verification |

As recommended by industry experts in the field of blockchain and insurance technology, zero – knowledge proof claims are a game – changer for the insurance industry. Top – performing solutions include working with blockchain platforms that have advanced zero – knowledge proof capabilities.

Try our zero – knowledge proof calculator to estimate the potential benefits for your insurance claim processes.

Key Takeaways:

- Zero – knowledge proof is a cryptographic method that can enhance insurance claim verification.

- It offers advantages such as enhanced privacy, reduced fraud, and faster claims processing.

- Insurance companies can use industry benchmarks from other financial sectors to implement zero – knowledge proof effectively.

- A comparison table shows the clear benefits over traditional claim verification methods.

FAQ

What is insurance liquidity mining?

According to industry insights, insurance liquidity mining combines insurance and liquidity mining in the DeFi space. It involves users providing liquidity to insurance – related DeFi protocols and earning rewards. The general idea of liquidity mining is to add assets to a pool, and in this case, insurance protects the pool funds. Detailed in our [Insurance liquidity mining] analysis.

How to participate in insurance liquidity mining?

To participate in insurance liquidity mining, first, thoroughly research DeFi projects. Review smart contract audit reports and assess market volatility of involved tokens. Then, choose a suitable insurance – related DeFi protocol and deposit your assets into its liquidity pool. Follow the protocol’s staking process to earn rewards. Detailed in our [Insurance liquidity mining] section.

Custodial vs non – custodial coverage: What’s the difference?

The main difference lies in the level of assistance required. Custodial coverage focuses on individuals needing help with activities of daily living (ADLs), covered by long – term care and sometimes traditional health insurance. Non – custodial coverage applies when the insured has more self – sufficiency, like a non – custodial parent insuring a child. Unlike non – custodial, custodial is more about basic self – care support.

Steps for implementing zero – knowledge proof claims in an insurance company

First, conduct a pilot project with a small group of policyholders. This helps identify and fix technical glitches. Next, choose a blockchain platform with advanced zero – knowledge proof capabilities. Then, train staff on the new process. Finally, gradually roll out the technology across the company. Detailed in our [Zero – knowledge proof claims] segment.